|

See all our previous

broadcasts

Return To Main

Time to fill up with Fossil, Grey Ammonia...

July 1 to July 10 of 2023.

Is this the second to the last time your farm ever

will fill up or use fossil ammonia?

The IRA and the Carbon Credits are bringing Fossil Ammonia to an end

from Texas to North Dakota.

The end of Fossil Ammonia is 2025 predictable.

Fossil Grey Ammonia has the potential to go back to $1,500 per ton

and higher..due to Putin's War and expansion thereof.

The US Great Plains Built Zero Carbon, Green ammonia has a level

price for 7 years in 2025 at $242 per ton.

US Wholesale Anhydrous Ammonia Prices Fall in April

Despite Strong Preplant Demand (dtnpf.com)

May 16, 2023 , DTN.

Outlook on Ammonia….Your

Great Plains Reporter Guy Swanson with DTN assisting.

A look into future.

Open up your check book July 1 to July 10 and take delivery. GJS.

This war is not over yet. Green Ammonia at $242 per ton is coming in

2025/2026 with Zero Carbon…and Carbon credits for the producer with

storage.

From

DTN.

Offers fell to a lesser degree from eastern Oklahoma area ammonia

producers compared to the Midwest. This was due to the ex-works

market having fallen lower earlier in the year due to building

length on supplies, reaching $475-$500/t FOB in April compared to

the $500-$525 range at the end of March. Ex works is a shipping

arrangement in international trade where a seller makes goods

available to a buyer, who then pays for transport costs.

U.S. ammonia prices are expected to continue declining once the

spring rush for product is over, following alongside the global

market.

While logistics remain constrained as usual via trucking routes, the

U.S. entered the spring season with a considerable amount of length

in the market, preventing the usual price hikes one might expect

during the period.

It would appear as always…the best time to fill up….about 90% of the

time is July 1 to July 10 of 2023.

AMMONIA

Domestic: Despite increasing spot demand for anhydrous ammonia in

April, price levels fell last month on account of a weaker global

market putting pressure on prices. This was at odds, however, with

the high amount of stocks in the U.S., which had been purchased

above $1,000 per short ton (t) free-on-board (FOB -- or sale cost

per ton without transportation costs included) in late 2022, which

led sellers to fight for higher values and limit their losses.

Ammonia in the Corn Belt was last reported from $750-$840/t FOB at

the beginning of April and end-of-March period. Following the lower

Tampa settlement set for May, prices at the end of last month

were heard at $250/t lower in the $500-$550/t FOB range.

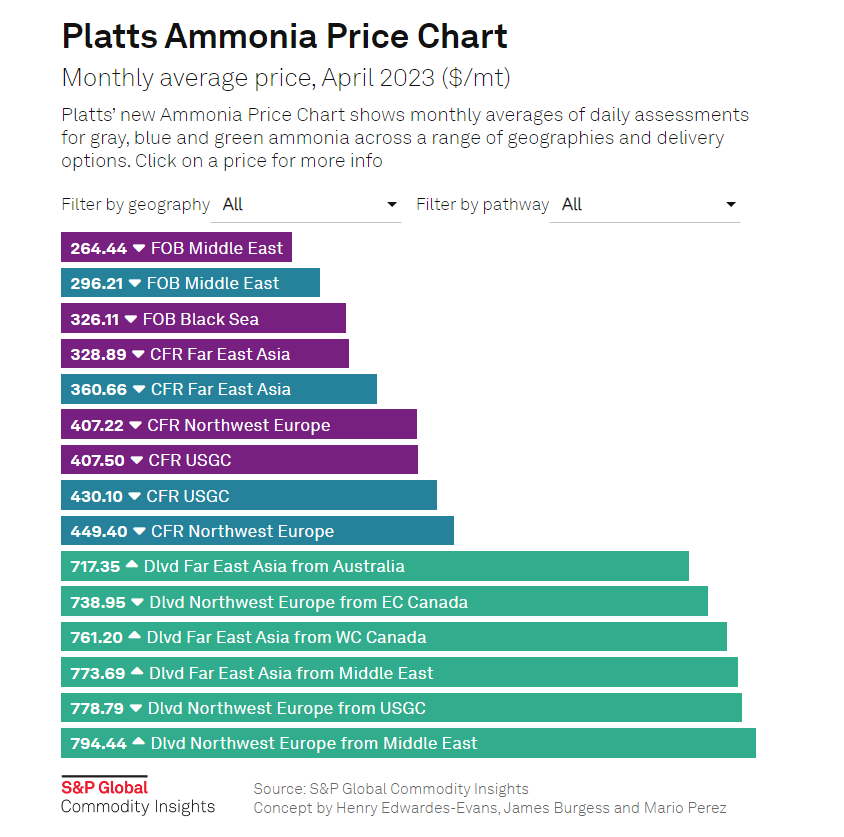

June 1, 2023. Your international pricing of Green Ammonia is

included. $652 per Short Ton from Australia.

So why build NH3 locally? Building local because that is where the

customer is...and furthermore that is

where the power is.

The Mega Plants cannot compete with local production on the Great

Plains.

-

Wind and Solar Power, with strong IRA Hydrogen Credits built with

Zero Carbon…Green Ammonia for Green Players are not yet available

in the USA. Not with Blue Ammonia or Yara

Clean Ammonia….Green Ammonia is best route for large

farmers of the Great Plains.

-

How can you build at such a low price of $242 per ton Zero Carbon

for 7 years?...the power cost is level

and calculated daily by local people at 1.8 to 2.1 cents per KW.

And that power cost is going down even more with free competition

from Solar and Wind Mill manufacturers.

-

Our goal is to build at lowest cost targeting, 1 kilo of hydrogen

for 1 dollar in the next 1 decade, 1-1-1. That means a very low

operational cost of somewhere between $100 and $160 per short ton

NH3 over the next decade…it does include the capital plant

investment which normally creates a double in cost. As a result we

add 10% to our cost to assure a profit for our investors.

-

For advanced Green Play Ammonia team players. A look into the

future. Why is your Green Play Ammonia, seven year, off take

agreement a safe bet and bankable…because it is built locally and

never imported. And you own it at your farm at a reasonable price.

-

This is a different approach for farmers and merchants that want

no Oligarch or Mega plant influence. This is the original plan of

50’s and 60’s. The plan was ownership of NH3 by farmers and

merchants the day it is built.

-

Small Optimized Zero Carbon Green Ammonia Plants that make money

for investors at 5/8 the infrastructure cost of a 2,500 ton per

day Mega Plant located on the Gulf Coast of four continents.

Inland stranded ammonia is a safe bet with local wind and solar

power of the Great Plains.

-

The fact that NH3 irrigation engines can

economically pump water from twice the depth of previous

engines assuring much higher water quality on the Great Plains.

And these engines come with Zero Carbon Emission Certificate and

carbon credits and a REAP grant.

-

The GPA Exactrix Tool Bar program is local with a much lower

fertilization cost and adding to the tax base and employment.

-

A better level of pricing and fresh restart with Zero Carbon NH3

price for the producer over 7 years.

You might ask your fertilizer dealer if he will give you a level

price for 7 years that fluctuates between $100 and $300 per ton.

Another good reason to source local from GPA optimum

sized plants on the Great Plains at $242 per short ton.

ENTER EXACTRIX®

Your Great Plains Reporter,

Guy J Swanson.

Exactrix Global Systems.

4501 East Trent Ave.

Spokane, Washington, 99212

509 254 6854 General Office.

509 995 1879 cell.

www.exactrix.com

www.greenplayammonia.com

Legal

Rights and Disclaimers

|